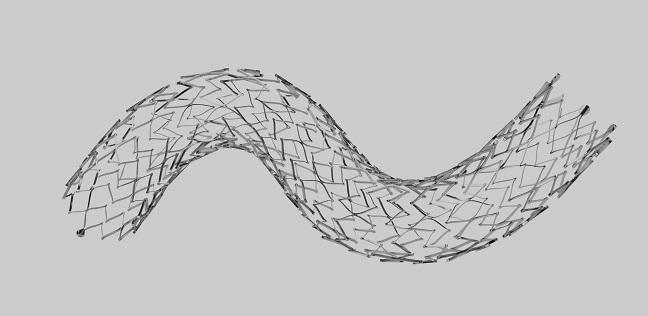

Abre Venous Stent Meets 30-Day, 1-Year Targets in Pivotal IDE Trial

If approved by the FDA, this device will join two others designed specifically for use in the veins.

Abre (Medtronic), a dedicated venous stent, has a 12-month primary patency rate of 88%, exceeding the performance goal for effectiveness in its pivotal investigational device exemption (IDE) trial. The findings were reported Wednesday during the virtual 2020 Charing Cross Symposium.

For the primary safety endpoint, ABRE study investigators found a 2% major adverse event (MAE) rate within 30 days. Additionally, 92.4% of patients were free from clinically driven TLR through 12 months.

This news brings Abre one step closer to the US market alongside the US Food and Drug Administration-approved Venovo (BD) and Vici (Boston Scientific) devices. All are self-expanding nitinol stents designed specifically for use in treating symptomatic iliofemoral venous outflow obstruction, and all have received CE Mark approval in Europe, as has the Zilver Vena (Cook Medical), which is now being studied in the US-based VIVO trial.

Explaining why a dedicated device is required, Stephen A. Black, MD (St Thomas’ Hospital, London, England), a global principal investigator of ABRE, told TCTMD that veins and arteries differ in terms of “how they are constructed and how they behave.” Veins tend to be larger, have a different wall structure, and respond differently to damage, he explained.

ABRE Results

ABRE enrolled 200 patients (mean age 51.5 years; 66.5% women) with symptomatic ilifemoral venous outflow obstruction at 24 US and European sites. This population included patients with postthrombotic syndrome (PTS), nonthrombotic iliac vein lesions (NIVL), and acute deep vein thrombosis (DVT); fully 44% required stents that extended below the inguinal ligament.

Devices were successfully deployed in 100% of patients. Within 30 days, there were four MAEs: a clinically significant pulmonary embolism and three cases of stent thrombosis. By 1 year, there had been two all-cause deaths, one clinically significant pulmonary embolism, one major bleeding complication, and eight cases of stent thrombosis. There were no instances of stent fracture—an important finding, Black said, given how many patients had stents below the inguinal ligament—or stent migration. Both quality of life and venous function were significantly improved at 1 year versus baseline.

Twelve-month primary patency differed by disease type, ranging from 79.8% in PTS to 87.1% in acute DVT and 98.6% in NIVL. For patients whose stent reached into the common femoral vein, patency was lower at 78%, “indicating the extent of disease in this population,” Black noted.

“Follow-up in the study will continue through at least 3 years to make sure that all of these results are sustainable and continued,” concluded Black.

How to Do It Well

To TCTMD, Black pointed out that proper sizing is key as the field transitions to nitinol stents from Wallstent (Boston Scientific), which is woven and elongates when compressed in the middle. Wallstent has long been used off-label in the venous setting but wasn’t designed specifically for the veins and only this year received FDA approval for this use.

Abre and Venovo are open-celled stents, which tend to be more flexible, whereas Vici is closed-cell, a design that generally offers greater strength, Black explained. Flexibility is particularly useful when crossing the “pinch point” of the inguinal ligament, he said, but this characteristic also means that open-cell stents can have a more ovoid rather than circular shape; whether this “aspect ratio” affects long-term outcomes isn’t yet known.

For operators choosing among devices and implanting them, it’s important to understand variations in how they behave, he said. “It’s a little bit like changing from tennis to squash. I use the same analogy for arterial and venous disease—all racket sports have a ball, but the rules are different.”

One viewer of the online session asked, during the discussion, how best to size Abre when treating nonthrombotic lesions.

In these instances, Black advised, “don’t size on the common iliac vein, which is the prestenotic dilation; you will tend to oversize your stent. My view is you choose a relatively normal segment of external iliac vein and use that to size the stent. I tend to use long stents in NIVL, because I think the longer stent anchored in the external iliac vein will not migrate. And stent migration is the biggest possible disaster you can have in NIVL patients.”

What should happen, another virtual attendee asked, in the case of symptomatic stent occlusion?

The key, Black replied, is to act promptly. “We follow stents very, very closely, because if you’re going to solve the problem of stent occlusion, you’ve got a very short window to do that. In my opinion, it’s probably 2 weeks at an absolute push to recover a stent that thromboses. In the early phase, thrombolysis with whatever technique you like and correction of whatever the underlying cause is are what you need to do,” he explained.

After that window, recanalyzing a thrombosed stent becomes much harder than the index procedure, Black stressed. “That’s very different from arterial and coronary experience. . . . There’s a lot we have to learn about the pathophysiology of what goes on, but those are difficult to recover.”

Black told TCTMD he expects Medtronic will submit these data to the FDA as soon as possible. If both Abre and Zilver Vena receive approval, this would mean five devices for venous use will be on the US market. “There will be a number of options for physicians to choose from which are on-label, which can only be a good thing for patients,” he commented.

Photo Credit: Medtronic

Caitlin E. Cox is Executive Editor of TCTMD and Associate Director, Editorial Content at the Cardiovascular Research Foundation. She produces the…

Read Full BioSources

Black SA. ABRE study: 12 month results of the Abre venous stent system. Presented on: June 16, 2020. Charing Cross Symposium.

Disclosures

- Black reports receiving consulting and speaking fees from Medtronic, Boston Scientific, WL Gore, Cook Medical, and Bard, as well as serving on the advisory boards of Medtronic, Boston Scientific, and WL Gore.

Comments