Bioresorbable Scaffold for CLTI Appears to Be an Economical Option: LIFE-BTK

The novel dissolvable therapy had a 93.2% probability of being cost-effective at a modest willingness-to-pay level.

LONDON, England—A recently approved drug-eluting bioresorbable scaffold for the treatment of below-the-knee (BTK) chronic limb-threatening ischemia (CLTI) is highly likely to be cost-effective for hospital systems in the United States, according to an economic analysis from the LIFE-BTK trial.

At 2 years, the Esprit BTK (Abbott), a dissolvable therapy for use in peripheral interventions, had a 93.2% probability of being cost-effective at an incremental willingness-to-pay threshold of $20,000.

Part of that cost-effectiveness hinges on the bioresorbable vascular scaffold (BVS) being associated with lower event rates over time, including TLR. Compared with percutaneous transluminal angioplasty (PTA), the BVS resulted in projected savings for both avoidance of the primary efficacy endpoint per patient over 2 years and for avoidance of clinically driven TLR.

“From a viability standpoint of the technique, at least in the United States healthcare system, the willingness-to-pay threshold is a conservative estimate, and we think that we meet that,” LIFE-BTK principal investigator Sahil Parikh, MD (NewYork-Presbyterian/Columbia University Irving Medical Center, New York, NY), said in his presentation here at the 2025 Charing Cross International Symposium. “Strategically speaking, the TLR event is the most expensive event in the lifecycle of these patients.”

The US Food and Drug Administration approved the scaffold in 2024 based on the 1-year results from LIFE-BTK. Recently, the 2-year data from the trial demonstrated sustained patency and safety with the BVS compared with conventional angioplasty alone, with lower rates of the combined primary efficacy endpoint of freedom from above-ankle amputation of the target limb, occlusion of the target vessel, binary restenosis of the target lesion, and clinically driven TLR.

While the economic analysis is relevant for US clinicians who have struggled to get payers to approve the therapy for their BTK patients, some countries have seen easier uptake of the new technology.

In New Zealand, for instance, the BVS is reimbursed alongside other endovascular technologies for PAD, noted moderator Andrew Holden, MBChB (Auckland Hospital, New Zealand). Acknowledging the importance of location and healthcare system tolerances, he stressed the importance of outlining exactly how much the BVS could save a given system by avoiding repeat interventions and poor outcomes.

”We’ve done that, and the case is very compelling,” Holden said. “But it really relies on doing a very thorough job of auditing the cost of reinvention in your local environment.”

While repeat interventions are common in BTK disease, several panelists noted that avoiding them and the toll they take on patients should somehow be factored into economic analyses.

Economic Endpoints

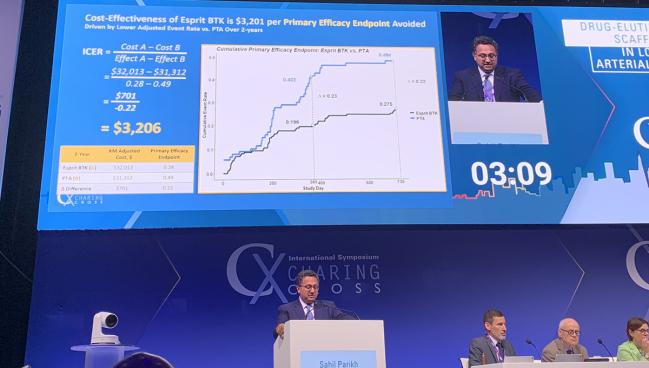

In his presentation, Parikh said the economic endpoints used in the analysis included the cost of the index procedure combined with follow-up, both inpatient and outpatient. The incremental cost effectiveness ratio (ICER) was the difference in total costs between the BVS and PTA divided by the difference in primary endpoint failure, as well as the difference in total costs divided by difference in clinically driven TLR endpoint failure.

Total patient costs at 2 years were $31,763 for BVS and $30,995 for PTA. Broken down by both index and follow-up costs, there were no significant differences.

Looking at the first ICER for avoidance of occurrence of the primary endpoint, the difference in the ICER calculation in favor of the BVS over PTA was a savings of $3,206 per patient driven by the lower adjusted event rate. For the second ICER of avoidance of clinically driven TLR, the difference was roughly double that at $6,068, again driven by the lower adjusted even rate.

In a sensitivity analysis that included multiple simulations, there was a 35.1% probability that the BVS as a primary strategy would save money over a PTA-first approach.

With the high probability of being cost-effective at the $20,000 willingness-to-pay strategy, Parikh said, “this should be something that helps us bring this to more patients who need it.”

Also backing up this thinking is the 2-year clinical data from LIFE-BTK, which indicate that the rate of clinically driven TLRs over time is roughly doubled in the PTA group compared with the BVS (18.6% vs 9.7%; log-rank P = 0.03).

To TCTMD, Parikh said the LIFE-BTK investigators believe the drug elution from the scaffold is an important element in preventing restenosis. The device consists of a bioresorbable poly-L lactide backbone with thin struts equivalent to contemporary coronary DES and a coating of everolimus.

“Admittedly, [LIFE-BTK] patients were not the most complex of the CLTI patients that we take care of, and even in this group of patients, we’ve seen important clinical and financial benefits,” Parikh noted.

Data from more complex patients will come from the ongoing registry of the postapproval study and should result in “a full complement of cost-effectiveness data” within 3 years, he added.

Another issue pertinent to the discussion is the use of multiple scaffolds for treating long segments in a given case, which is not uncommon in BTK intervention. Parikh said other economic models are being developed that factor in this need and help shift the focus to costs per case rather than per lesion treated.

“The longer the lesion, the equal or more benefit was observed in the [LIFE-BTK] trial,” he added. “The delta between the two groups was even greater, so I think that that’s something that’s very clear in our clinical experience. Those that have been using it for the past year [have] gotten increasingly comfortable treating long segments.”

L.A. McKeown is a Senior Medical Journalist for TCTMD, the Section Editor of CV Team Forum, and Senior Medical…

Read Full BioSources

Parikh S. An update and new cost-effectiveness data from the LIFE-BTK RCT. Presented at: CX Symposium. April 23, 2025. London, England.

Disclosures

- Parikh reports serving on advisory boards for Abbott Vascular, Boston Scientific, Cordis, Medtronic, and Philips; receiving institutional research funding from Abbott Vascular, Boston Scientific, Surmodics, TriReme Medical, Shockwave Medical, Reflow Medical, Acotec, and Concept Medical; consulting for Terumo, Inari, Penumbra, and Canon; and having equity in Advanced Nanotherapies, eFemoral, and Encompass Vascular.

Comments