FDA Approves Shockwave Intravascular Lithotripsy for Calcified Coronaries

Dean Kereiakes says simplicity, safety, and efficacy make the choice a no-brainer. The sticker price may raise eyebrows.

Photo Credit: Shockwave Medical

(UPDATED) The US Food and Drug Administration has cleared the Shockwave intravascular lithotripsy (IVL) system for the treatment of severely calcified coronary artery plaques.

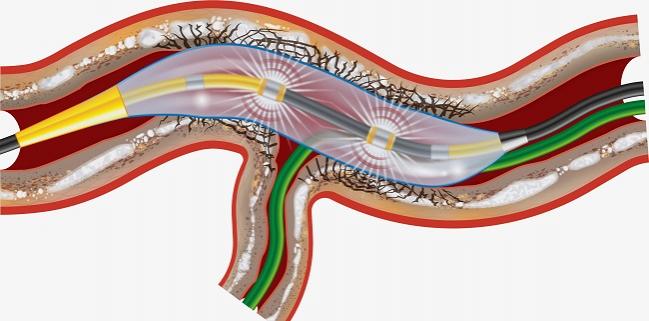

The device uses a balloon to deliver sonic pressure waves that can pass through soft arterial tissue to “preferentially disrupt” calcified plaque and optimize stent placement. It thus holds the potential to displace rotational and orbital atherectomy devices that have been the market standard for these lesions.

A company spokesperson confirmed, however, that the device will likely be priced at a “premium,” significantly higher than existing atherectomy systems currently reimbursed by the US Centers for Medicare and Medicaid Services (CMS), as it has in other international markets that have cleared it. One interventionalist who spoke with TCTMD said that operators will be eager to use this new option for the coronaries but that, depending on how CMS opts to reimburse the Shockwave product, hospitals may ration its use.

Calcified De Novo Disease

The Shockwave IVL System (Shockwave Medical) with the Shockwave C2 Coronary IVL Catheter is indicated for “lithotripsy-enabled, low-pressure balloon dilatation of severely calcified, stenotic de novo coronary arteries when used prior to stenting,” a press release notes.

Premarket approval was based in part on results from DISRUPT CAD III, the single-arm, pivotal trial released at the virtual TCT meeting last October. As reported by TCTMD, the multinational trial enrolled 431 patients with severely calcified de novo coronary artery lesions amenable to Shockwave. At 30 days, freedom from MACE (the primary safety endpoint) was observed in 92.2% of patients, exceeding the performance goal. Procedural success (the primary effectiveness endpoint) occurred in 92.4%, also exceeding the performance goal.

In the trial, stent expansion, even in areas of maximum calcification, was as much as 102%, which principal investigator Dean Kereiakes, MD (The Christ Hospital Heart and Vascular Center, Cincinnati, OH), called “kind of jaw-dropping” for these kinds of lesions. Suboptimal stent expansion is a known predictor of later stent thrombosis and restenosis.

Full DISRUPT CAD III results were published in late 2020 in the Journal of the American College of Cardiology.

Shockwave’s peripheral lithotripsy system was cleared by the FDA in 2016 for use in severely calcified PAD, so users are already familiar with the system, Kereiakes told TCTMD today, adding that “anybody who’s ever worked in the vascular space” will appreciate the simplicity of using a balloon in calcified vessels. Atherectomy devices, he pointed out, are subject to wire bias, potentially leading to eccentric ruts or troughs where the burr “rides the wire.” By contrast, the balloon-based Shockwave acts more concentrically in the calcified space.

“I think there is a great deal of enthusiasm” for using IVL in the coronaries, Kereiakes said. “From my perspective, it’s the safest, most-predictable and -effective way to modify calcium to optimize stent deployment. It really is. The results are pretty spectacular: abrupt closures, perforations, and no recoil were all zero in [DISRUPT] CAD III after IVL alone.”

A patient-level pooled analysis now in the works combining 628 patients in the CAD I to IV trials also “basically says zero” for these same three adverse events, he added.

Sticker Shock?

But hospital budgets may dampen enthusiasm.

A company spokesperson confirmed to TCTMD that the cost of the technology will be steeper than atherectomy devices on the market today, which start at about $2,000, depending on volume commitments established with manufacturers—the plan, revealed on an earnings call following the approval announcement, is to price the Shockwave C2 at $4,700, which will be a standardized national price.

“We believe it is a novel, differentiated product that safely improves PCI outcomes, is easy to use, and expands the population of patients that cardiologists can safely treat. Further, the device price is a component of the IVL procedure costs, which CMS evaluates when determining both add-on and long-term payment levels,” Shockwave Medical’s Scott Shadiow told TCTMD. “We have set the C2 price at a level that we believe will optimize the future reimbursement of IVL. For near-term reimbursement, one of the benefits of being included in the FDA’s ‘Breakthrough’ program is its alignment with CMS’ NTAP [New Tech Add-On Payment] & TPT [Transitional Pass Through] reimbursement programs for inpatient and outpatient procedures. We have already submitted an application for [an] NTAP to CMS. If awarded, this will provide incremental payment for IVL in the inpatient setting. Now that we have received our approval, we will soon be applying for the TPT. If awarded, this will provide incremental payment for when IVL is used in the hospital outpatient setting. We hope to have both the NTAP and TPT payments in place within the year.”

Following the Shockwave earnings call and in response to social media posts reacting to the price tag, Shadiow fleshed out his remarks in an email noting that “reimbursement considerations” are just one of multiple factors that go in to determining the price of any new medical technology, along with R&D investment, cost to manufacture the new technology, and market prices of other technologies. “We believe we offer a product with distinct clinical advantages that improve PCI outcomes and expand the patient population that interventional cardiologists can safely treat. Currently, the market-leading atherectomy device costs about $4,000 per procedure in most US hospitals, and we believe a premium to the current market is warranted based on the factors mentioned above.”

Moreover, he added, “most novel medical technologies, like IVL, do not come out of the gate with reimbursement and thus, need to navigate a complex, multiyear pathway in order to better facilitate physician and hospital access to the technology. Shockwave believes that our device and procedure costs will be consistent with the requirements set forth by CMS for both temporary add-on payments and long-term reimbursement levels that will provide hospitals and physicians an adequate economic support system for coronary IVL.”

Kereiakes believes that, given the simplicity of the device and the lack of learning curve, physicians would preferentially use lithotripsy over other options if price were not a barrier.

Without reimbursement, he predicted, they will likely use it more selectively in larger vessels and bifurcations. “The higher the price of the device in the absence of adequate reimbursement will restrain physician use, whether they like it or not. The hospitals will [ask that] of physicians. . . . If the price is lower, people would use it on almost every case.”

The Shockwave C2 system has not been tested head-to-head against atherectomy, Kereiakes acknowledged. Instead, DISRUPT CAD III was designed to enroll the same population, using the same definitions and endpoints as in ORBIT II, which was the pivotal trial that paved the way for orbital atherectomy’s approval in 2013.

“We tried to create a performance goal for safety and a performance goal for efficacy that were directly taken from ORBIT II. That is the next best thing—not as good—but the next best thing to a head-on comparison,” Kereiakes said. “And frankly, we knocked it out of the park, a home run . . . even for first-time users.”

Shelley Wood was the Editor-in-Chief of TCTMD and the Editorial Director at the Cardiovascular Research Foundation (CRF) from October 2015…

Read Full BioSources

Shockwave Medical. Shockwave intravascular lithotripsy FDA-approved to treat advanced heart disease. Published and accessed on: February 16, 2021.

Disclosures

- Kereiakes reports consulting for SINO Medical Sciences Technologies Inc, Boston Scientific, Elixir Medical, Svelte Medical Systems Inc, Caliber Therapeutics/Orchestra Biomed, and Shockwave Medical; and being a stockholder in Ablative Solutions Inc.

Comments